Difference between revisions of "The Basin Fund"

Cellsworth (Talk | contribs) |

Cellsworth (Talk | contribs) |

||

| (7 intermediate revisions by the same user not shown) | |||

| Line 17: | Line 17: | ||

</table> | </table> | ||

| − | [[File:BasinFund. | + | [[File:BasinFund.png|center|thumb|600px|https://www.usbr.gov/uc/progact/amp/twg/2023-06-15-twg-meeting/20230615-ImpactsHydropowerCustomersBasinFundConductingExperiments-508-UCRO.pdf]] |

<!-- | <!-- | ||

| Line 61: | Line 61: | ||

== How are the costs associated with experimentation and the environmental programs paid for? == | == How are the costs associated with experimentation and the environmental programs paid for? == | ||

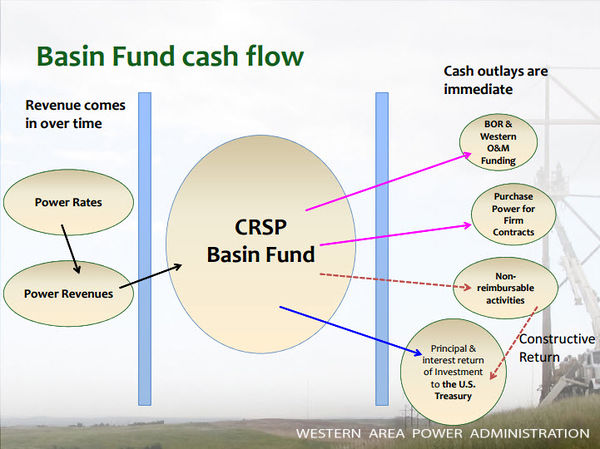

*Costs incurred during experimentation, like funding dedicated to environmental programs, are booked as a non-reimbursable activity. | *Costs incurred during experimentation, like funding dedicated to environmental programs, are booked as a non-reimbursable activity. | ||

| − | *This means they can be booked as a constructive return (i.e. in lieu of an actual cash return) to the U.S. Treasury as a payment against the | + | *This means they can be booked as a constructive return (i.e. in lieu of an actual cash return) to the U.S. Treasury as a payment against the funds that were obligated to construct the CRPS units. |

*The amount WAPA returns to the Treasury for the construction of the CRSP units is finite and scheduled. | *The amount WAPA returns to the Treasury for the construction of the CRSP units is finite and scheduled. | ||

*As the amount WAPA needs to return to the Treasury gets smaller, the amount of interest incorporated in the return also gets smaller. | *As the amount WAPA needs to return to the Treasury gets smaller, the amount of interest incorporated in the return also gets smaller. | ||

| Line 81: | Line 81: | ||

==How much does the Federal Government make off of power revenues at Glen Canyon Dam?== | ==How much does the Federal Government make off of power revenues at Glen Canyon Dam?== | ||

*None | *None | ||

| − | *Legislation requires full cost recovery, meaning, total revenue | + | *Legislation requires full cost recovery for maintaining and operating the project, meaning, total revenue has to equal total costs. Profits are not allowed. |

| − | *Total annual revenue and costs | + | *Total annual revenue and costs to maintain and operate the SLCA/IP is about $200 million/year [https://www.usbr.gov/uc/progact/amp/amwg/2016-08-24-amwg-meeting/Attach_08.pdf] |

== Can appropriations be used to support the Colorado River Storage Project? == | == Can appropriations be used to support the Colorado River Storage Project? == | ||

| Line 109: | Line 109: | ||

|style="color:#000;"| | |style="color:#000;"| | ||

| − | + | *[[Media:Basin Fund AMWG Aug 2023.pdf| 2023 CRSP and Basin Fund Overview]] | |

| − | *[https://www.usbr.gov/uc/progact/amp/amwg/2015-08-26-amwg-meeting/Attach_08.pdf CRSP Rates, Revenue, and Basin Fund Overview] | + | *[https://www.usbr.gov/uc/progact/amp/amwg/2015-08-26-amwg-meeting/Attach_08.pdf 2015 CRSP Rates, Revenue, and Basin Fund Overview] |

| + | *[[Media:210307_GCPA_Nonreimbursables.doc| GCPA and Nonreimbursable expenses]] | ||

|- | |- | ||

| − | ! <h2 style="margin:0; background:#cedff2; font-size:120%; font-weight:bold; border:1px solid #a3b0bf; text-align:left; color:#000; padding:0.2em 0.4em;"> 1956 CRSP Act: Establishment of the Basin Fund </h2> | + | ! <h2 style="margin:0; background:#cedff2; font-size:120%; font-weight:bold; border:1px solid #a3b0bf; text-align:left; color:#000; padding:0.2em 0.4em;"> [https://www.usbr.gov/lc/region/g1000/pdfiles/crspuc.pdf 1956 CRSP Act]: Establishment of the Basin Fund </h2> |

|- | |- | ||

|style="color:#000;"| | |style="color:#000;"| | ||

| Line 145: | Line 146: | ||

Sec. 1804e (Allocation of Costs) states: "The Secretary of the Interior, in consultation with the Secretary of Energy, is directed to reallocate the costs of construction, operation, maintenance, replacement and emergency expenditures for Glen Canyon Dam among the purposes directed in section 1802 of this Act and the purposes established in the Colorado River Storage Project Act of April 11, 1956 (70 Stat. 170). Costs allocated to section 1802 purposes shall be nonreimbursable."[http://gcdamp.com/index.php/Grand_Canyon_Protection_Act] | Sec. 1804e (Allocation of Costs) states: "The Secretary of the Interior, in consultation with the Secretary of Energy, is directed to reallocate the costs of construction, operation, maintenance, replacement and emergency expenditures for Glen Canyon Dam among the purposes directed in section 1802 of this Act and the purposes established in the Colorado River Storage Project Act of April 11, 1956 (70 Stat. 170). Costs allocated to section 1802 purposes shall be nonreimbursable."[http://gcdamp.com/index.php/Grand_Canyon_Protection_Act] | ||

| − | Making the impacts to hydropower "nonreimbursable" shifted the burden of financial costs associated with the GCPA from power customers to the Federal Government (i.e., the U.S. taxpayer). According the the GCPA, experimental releases cannot trigger a CRC (Cost Recovery Charge) because those costs cannot be "recovered" from power customers. | + | Making the impacts of the GCPA to hydropower "nonreimbursable" shifted the burden of financial costs associated with the GCPA from power customers to the Federal Government (i.e., the U.S. taxpayer). According the the GCPA, experimental releases cannot trigger a CRC (Cost Recovery Charge) because those costs cannot be "recovered" from power customers. |

If an experimental release depleted the Basin Fund, the options for moving forward would have to include: | If an experimental release depleted the Basin Fund, the options for moving forward would have to include: | ||

Latest revision as of 16:13, 16 December 2024

|

|

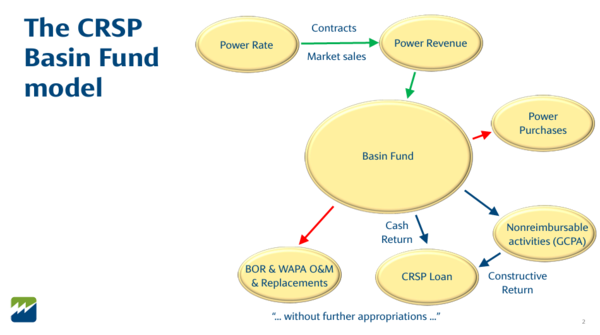

The Upper Colorado River Basin Fund (Basin Fund) was established under Section 5 of the 1956 Colorado River Basin Project (CRSP) Act. The CRSP Act 'authorized a separate fund in the Treasury of the United States to be known as the Upper Colorado River Basin Fund... for carrying out provisions of this Act other than Section 8'. Money appropriated for construction of CRSP facilities, except recreation and fish and wildlife facilities constructed under Section 8, is transferred to the Basin Fund from the General Fund of the Treasury. Revenues derived from operation of the CRSP and participating projects are deposited in the Basin Fund. Most of the revenues come from sales of hydroelectric power and transmission services. The Basin Fund also receives revenues from M&I water service sales, rents, salinity funds from the Lower Colorado Basin (as a pass-through for the Colorado River Basin Salinity Control Program), and miscellaneous revenues collected in connection with the operation of the CRSP and participating projects. Revenues and appropriated funds are accounted for separately in the Basin Fund. [1] |

| -- |

-- |

-- |

|---|

|

|