What are Basin Fund revenues used for?

|

|

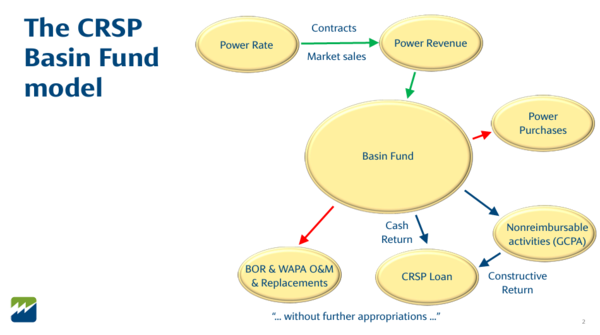

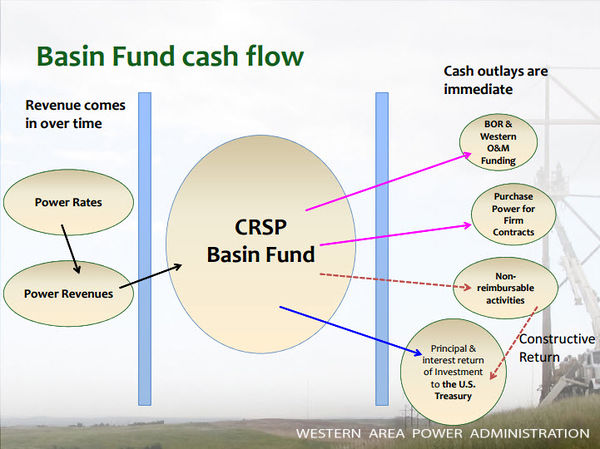

Basin Fund revenues must first be used to repay costs associated with the operation, maintenance, and replacements of, and emergency expenditures for, the CRSP initial units. The fund is then used to repay the United States Treasury Department for the following:

- The construction costs of the CRSP initial units allocated to the power purpose (with interest thereon)

- The construction costs of the CRSP initial units allocated to irrigation

- A portion of salinity investment and operation costs

- The construction costs of the participating projects allocated to the irrigation investment and above the irrigator's ability to pay

The Basin Fund also supports the following:

- Cost sharing for Colorado River Basin Salinity Control Program (approximately $2.0 million annually)

- The major portion of the cost of the Glen Canyon Adaptive Management Program (currently almost $9.5 million annually)

- Cost sharing for the Upper Colorado and San Juan Endangered Fish Recovery Implementation Programs (currently approximately $7 million annually)

- Water quality studies

- Consumptive use studies

The approximately $16.5 million per year of power revenues expended for the Glen Canyon Adaptive Management Program, the Upper Colorado River Recovery Implementation Program, and the San Juan Basin Recovery Program are expenses that are not built into the firm power rates. This arrangement benefits the programs in that they do not need to seek annual appropriations from Congress for these funds. However, this does have an impact to Western in times when firming power purchase expenses are high (due to drought or experimentation) because the moneys are transferred to the program and are not available to purchase the power needed to meet contractual requirements. The Basin Fund is managed by Western. Approximately $120 million in revenue is needed each year to fund Reclamation and Western operation and maintenance needs. Western is responsible for transmission and marketing of CRSP power, collecting payment for the power, and transfer of revenues for repayment to the United States Treasury Department. A change in the amount of available capacity or energy could potentially affect the revenue derived from the sale of energy and the contributions to the Basin Fund, or rates charged to power customers. [2]

How are the costs associated with experimentation and the environmental programs paid for?

- Costs incurred during experimentation, like funding dedicated to environmental programs, are booked as a non-reimbursable activity.

- This means they can be booked as a constructive return (i.e. in lieu of an actual cash return) to the U.S. Treasury as a payment against the funds that were obligated to construct the CRPS units.

- The amount WAPA returns to the Treasury for the construction of the CRSP units is finite and scheduled.

- As the amount WAPA needs to return to the Treasury gets smaller, the amount of interest incorporated in the return also gets smaller.

- As these amounts gets smaller over time, it reduces the amount WAPA can claim as a non-reimbursable return.

- Over time, this reduces the amount of funding available for non-reimbursable activities like experimentation and environmental programs.

What happens if the amount in the Basin Fund falls below the amount necessary to purchase power for firm contracts?

Some combination of the following:

- Reduce funding for non-reimbursable activities (experiments, research and monitoring, recovery programs, salinity control)

- Increase power rates through a Cost Recovery Charge (CRC)

- Reduce allocations for firm power contracts (purchase power or firming)

- Reduce BOR and WAPA O&M funding

- Increase power revenues through a re-operation of the CRSP facilities (i.e. relax environmental restrictions)

How has re-operation at Glen Canyon Dam affected power revenues?

- 1996 EIS and MLFF

- 2016 LTEMP EIS

How much does the Federal Government make off of power revenues at Glen Canyon Dam?

- None

- Legislation requires full cost recovery for maintaining and operating the project, meaning, total revenue has to equal total costs. Profits are not allowed.

- Total annual revenue and costs to maintain and operate the SLCA/IP is about $200 million/year [3]

Can appropriations be used to support the Colorado River Storage Project?

The 1956 CRSP Act (Section 5c) states that "all revenues collected in connection with the operation of the Colorado River storage project and participating projects shall be credited to the Basin Fund, and shall be available, without further appropriation, for defraying the costs of operation, maintenance, and replacements of, and emergency expenditures for, all facilities of the Colorado River storage project and participating projects..." This would indicate that the CRSP was intended to operate and maintain itself without additional appropriations.

|

|

Links

|

|

|

Presentations and Papers

|

|

|

1956 CRSP Act: Establishment of the Basin Fund

|

|

Section 5.

(a) There is hereby authorized a separate fund in the Treasury of the United States to be known as the Upper Colorado River Basin Fund (hereinafter referred to as the Basin Fund) which shall remain available until expended, as hereafter provided, for carrying out provisions of this Act other than section 8.

(b) All appropriations made for the purpose of carrying out the provisions of this Act, other than section 8, shall be credited to the Basin Fund as advances from the general fund of the Treasury.

(c) All revenues collected in connection with the operation of the Colorado River storage project and participating projects shall be credited to the Basin Fund, and shall be available, without further appropriation, for

- defraying the costs of operation, maintenance, and replacements of, and emergency expenditures for, all facilities of the Colorado River storage project and participating projects, within such separate limitations as may be included in annual appropriation acts: Provided, That with respect to each participating project, such costs shall be paid from revenues received from each such project;

- payment as required by subsection (d) of this section; and

- payment as required by subsection (e) of this section.

Revenues credited to the Basin Fund shall not be available for appropriation for construction of the units and participating projects authorized by or pursuant to this Act.

(d) Revenues in the Basin Fund in excess of operating needs shall be paid annually to the general fund of the Treasury to return--

- the costs of each unit, participating project, or any separable feature thereof which are allocated to power pursuant to section 6 of this Act, within a period not exceeding fifty years from the date of completion of such unit, participating project, or separable feature thereof;

- the costs of each unit, participating project, or any separable feature thereof which are allocated to municipal water supply pursuant to section 6 of this Act, within a period not exceeding fifty years from the date of completion of such unit, participating project, or separable feature thereof;

- interest on the unamortized balance of the investment (including interest during construction) in the power and municipal water supply features of each unit, participating project, or any separable feature thereof, at a rate determined by the Secretary of the Treasury as provided in subsection (f), and interest due shall be a first charge; and

- the costs of each storage unit which are allocated to irrigation pursuant to section 6 of this Act within a period not exceeding fifty years.

|

How does the Grand Canyon Protection Act and experimental releases interplay with the Basin Fund?

|

|

Sec. 1804e (Allocation of Costs) states: "The Secretary of the Interior, in consultation with the Secretary of Energy, is directed to reallocate the costs of construction, operation, maintenance, replacement and emergency expenditures for Glen Canyon Dam among the purposes directed in section 1802 of this Act and the purposes established in the Colorado River Storage Project Act of April 11, 1956 (70 Stat. 170). Costs allocated to section 1802 purposes shall be nonreimbursable."[4]

Making the impacts of the GCPA to hydropower "nonreimbursable" shifted the burden of financial costs associated with the GCPA from power customers to the Federal Government (i.e., the U.S. taxpayer). According the the GCPA, experimental releases cannot trigger a CRC (Cost Recovery Charge) because those costs cannot be "recovered" from power customers.

If an experimental release depleted the Basin Fund, the options for moving forward would have to include:

- Reduce funding for non-reimbursable activities

- Reduce purchase power for firm power contracts

- Reduce BOR and WAPA O&M funding, or

- Increase power revenues through a re-operation of the CRSP facilities (i.e. relax environmental restrictions)

|

|